FIFO (First In, First Out) and LIFO (Last In, First Out) are two accounting methods for the value of inventory held by the company. FIFO and LIFO are the two most common cost flow assumptions made in costing inventories. The amounts assigned to the same inventory items on hand may be different under each cost flow assumption. Therefore, the LIFO cost of the 70 units sold is $3,070 [30@$46 + 30@$43 + 10@$40]. LIFO also means that the 20 units remaining in inventory had the oldest cost of $40 each for a total of $800. The FIFO method assumes that the oldest inventory units are sold first, while the LIFO method assumes that the most recent inventory units are sold first.

COGS Valuation

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Our popular accounting course is designed for those with no accounting background or those seeking a refresher. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

- Elsa’s Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts, Information relating to Elsa’s purchases of Xpert snowboards during September is shown below.

- Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently.

- LIFO also means that the 20 units remaining in inventory had the oldest cost of $40 each for a total of $800.

- In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age.

How Does LIFO and FIFO Impact Net Income?

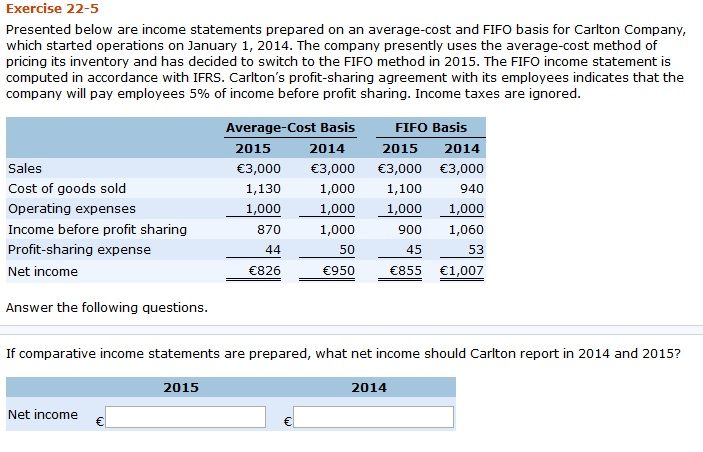

The cost of sales figure should also be adjusted by subtracting the increase in the LIFO reserve during the period from the cost of sales amount reported on the income statement. Finally, weighted average cost provides a clearer position of the costs of goods sold, as it takes into account all of the inventory units available for sale. This gives businesses a better representation of the costs of goods sold. Businesses would use the weighted average cost method because it is the simplest of the three accounting methods. The FIFO and LIFO methods impact your inventory costs, profit, and your tax liability.

International Accounting Standards

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Each approach has distinct advantages and drawbacks, affecting everything from profit margins to tax liabilities. Understanding these impacts is crucial for making informed decisions that align with both regulatory requirements and strategic goals. Accounting for inventory is essential—and proper inventory management helps you increase profits, leverage technology to work more productively, and to reduce the risk of error. FIFO is the more straightforward method to use, and most businesses stick with the FIFO method. The formula to calculate the earnings per share (EPS) metric, on a fully diluted basis, is as follows.

Conversion of Reported Financial Statements from LIFO to FIFO

FIFO and LIFO are the two most common inventory valuation methods used by public companies, per U.S. LIFO usually doesn’t match the physical movement of inventory, as companies may be more likely to try to move older inventory first. However, companies like car dealerships or gas/oil companies may try to sell items marked with the highest cost to reduce their taxable income.

Consequently, this can lead to higher gross profits and net income, which may appeal to investors and stakeholders looking for strong financial performance. Indicate which of these items would typically be reported as inventory in the financial statements. If an item should not bereported as inventory, indicate how it should be reported in the financial statements. The average cost method produces results that fall somewhere between FIFO and LIFO. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses.

The company made inventory purchases each month for Q1 for a total of 3,000 units. However, the company already had 1,000 units of older inventory that was purchased at $8 each for an $8,000 valuation. The choice of inventory accounting method also has long-term tax implications.

Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex. Knowing how to manage inventory is a critical tool for companies, small or large; as well as a major success factor for any business that holds inventory. Managing inventory can help a company control and forecast its earnings.

So the cost of the inventory added to the stock today will be exactly equal to the cost of the inventory added to the stock one year ago. Hence, whether you use the LIFO method or FIFO method, the value of the inventory expensed or even that in stock will also come out to be the same. The company states with no income tax won’t be able to sell exactly 100 units of products during each period. It will have to sell them as per the orders it receives and the availability of the products in its stock of finished goods. So suppose that the company gets orders of 150 units after producing the 3rd batch of 100 units.

In addition to being allowable by both IFRS and GAAP users, the FIFO inventory method may require greater consideration when selecting an inventory method. In addition, many companies will state that they use the “lower of cost or market” when valuing inventory. FIFO and LIFO are two methods of accounting and reporting inventory value.

As a result, the company would record lower profits or net income for the period. However, the reduced profit or earnings means the company would benefit from a lower tax liability. In our bakery example, the average cost for inventory would be $1.125 per unit, calculated as [(200 x $1) + (200 x $1.25)]/400. Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. The valuation method that a company uses can vary across different industries. Below are some of the differences between LIFO and FIFO when considering the valuation of inventory and its impact on COGS and profits.