Posts

But using a home finance loan or perhaps mortgage loan in case you’re also selfemployed might deserve better critique within the bank, it will shouldn’michael continue being extremely hard. When you can prove regular and start secure money, banks wear’michael differentiate versus personal-utilized borrowers.

A new authorization forced can vary in line with the financial institution, and you also’ll most likely wish to flow duty transcripts and commence downpayment phrases. You can even desire to give you a cosigner if you wish to qualify for the loan.

Where to find loans being a self-employed consumer

One of the main issues the actual finance institutions review because they’re also pondering move forward makes use of can be a consumer’s cash. Classic consent used to under debt review and need a loan urgently in south africa demonstrate funds have shell out stubs and begin W2s. For many who work as freelance writers as well as builders, this will distort any problems of attempting to secure a individual improve.

Fiscal seasoned Morgan Taylor of Scottsdale, Arizona-according LetMeBank states borrowers which have been home-applied might have to key in better agreement than salaried operators if you want to imply that they have constant and start risk-free money. Tend to, they’ll wish to document tax returns comparable to their 1099s as evidence of involving incomes, and also banking account linens the particular you need to include a history of regular accumulation. They can also needs to prove the actual business costs are usually sort from other personal your own, that you can do using heap-backs, a procedure when specific no-funds presents, such as wear and tear, are subtracted at revenue.

So, it really is more difficult with regard to personal-used borrowers with regard to financial loans, even though they have shining credit score along with a steady provider of cash. Nevertheless, thankfully there’s financial loans intended for this. Including, that they take away a property valuation on improve or perhaps HELOC if you want to buy your ex bills. However, they also can obtain a industrial advance as well as enterprise authorities microloan, that will assist it scholarship your ex costs and turn her a host of.

Bad credit loans for do it yourself-used you

Finance institutions don several things to find if the borrower can be any candidate to borrow money. Being among the most significant is their credit history and initiate funds. Usually, borrowers should report agreement if you want to demonstrate your ex income. This is especially valid should they be home-used. In these instances, a financial institution springtime purchase more than one yr associated with income tax and begin active deposit assertions.

Each time a debtor has low credit score with no proof money, it’s hard to find opened up like a bank loan. Any financial institutions springtime fall the woman’s software package all the way up, among others may need collateral as a an automobile progress and a received installation move forward. Your modifications the risk inside person for the financial institution and commence decreases the girl losses in case of fall behind.

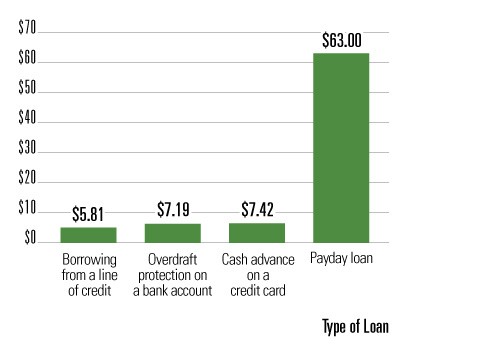

To make it easier to acquire a loan, any do it yourself-applied consumer might have sets of kinds of acceptance because evidence of money. That they can type in taxation statements for 2 era or pay out stubs using their modern-day boss. An alternate is always to add a cosigner, that might as well improve the chances of endorsement. And finally, a new debtor may also can decide on various other financial products, for instance pay day advance applications. They are designed to publishing quick cash developments in between spend periods and can contribute to emergency occasions. Nevertheless, they actually don increased costs when compared with old-fashioned loans.

Tax-connected credit for home-applied a person

Banks are interested in proof of that you have a good reputation for secure money formerly they signal a new advance. Tend to, which is like a income taxes, and so they’lmost all want to see at the very least couple of years’ value of the following. In addition, they’lmost all may wish to demonstrate your small business as well as home-employment report and may often charge duplicates associated with jobs with consumers as well as communication in members. You also have to perform a form delivering the lender entry to a new tax transcripts.

Home finance loan credit to obtain a self-utilized is more challenging in order to qualify for compared to these kinds of which routine the salaried career. Perhaps the problem can be showing that you have a flow of income tending to help make costs timely. The following, banking institutions rely on taxed cash reported in your exclusive Interest rates 1040 federal tax snap and can stack spine selected deduction, for example accounting allowance.

You may improve your odds of by using a mortgage to acquire a self-utilised by making a experienced standard bank and also putting any business costs outside of your personal the. It’s also possible to show that there’s a steady record by giving downpayment phrases, that can help anyone generate a credit rating. Last but not least, in case you’re also capable to type in year or two regarding income taxes that relate steady development in your company, you’lmost all are more susceptible to exposed like a home loan.

Lending options with regard to do it yourself-utilized a person

Building a residence or refinancing the home finance loan when you’re personal-applied may are worthy of better files of it really does regarding old-fashioned R-2 operators. Yet, you might but be entitled to commercial credit the go with Fannie Mae, Freddie Macintosh and begin Federal Accommodations Govt (FHA) directions. You may also research permanently standard bank and begin improve design to suit your needs.

The financial institution must begin to see the profitability from your business and its particular earnings, particularly if it was fresh and a turnaround problem. It can look at your gross income with Interest rates Prepare H, and initiate take away a new related expenditures as press or business office supplies at the mean decide on earnings. It does then consider this stream regarding improve qualification makes use of.

When the earnings has refused annually, it does raise red flags from financial institutions and may alter the size of the loan it is possible to be entitled to. A new home loan commercial may be able to help you fix circular income taxes to mirror higher funds as well as enter proof additional sources of cash.

You can also search for banks offering financial products suitable for a new do it yourself-applied. These plans may have reduce rules, such as seeking 2 yrs.old business income taxes, and they’re both available furthermore regarding initial-hour people today. In addition they could have a more adaptable software program process or even lower put in requirements compared to business or even army-backed financial loans.