³ The newest Annual Fee Produce (“APY”) on the Chime Family savings is varying and may alter whenever. Backlinks in this post, along with products and labels seemed on the ‘Sponsored’ articles, can get earn all of us an affiliate marketer payment. This won’t impact the opinions and you can suggestions of our editors.

- Luke is actually a gaming blogger which have a background inside the commission processors and you can fintech innovations from the playing industry.

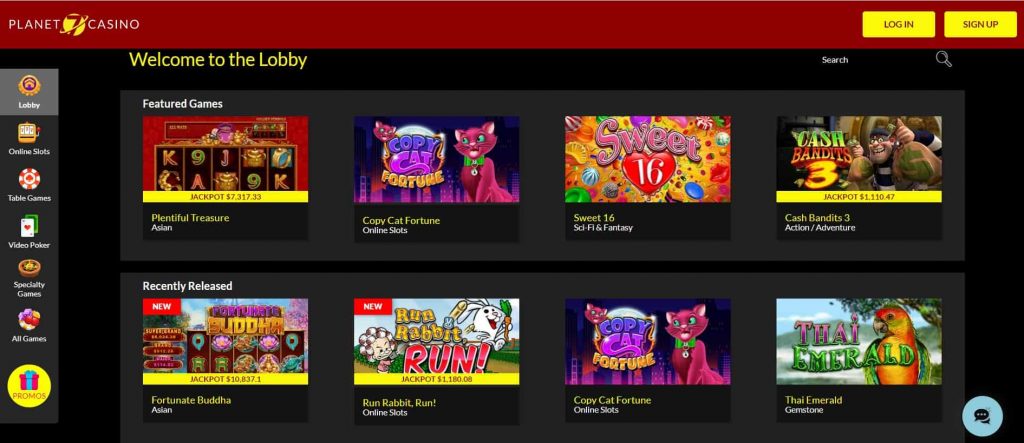

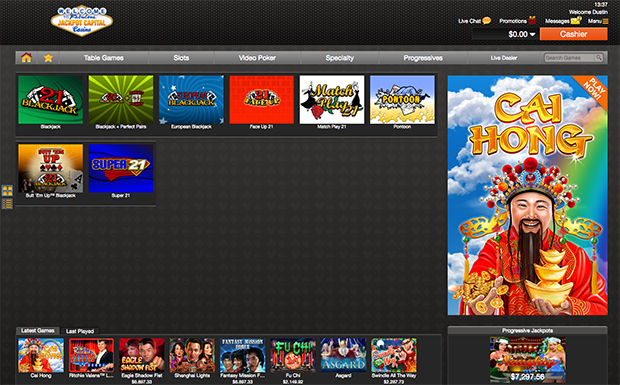

- By to play in the shell out by the mobile phone gambling enterprises, you can access lots of top quality online casino games, and those who might possibly be not available in the normal casinos on the internet and land-based spots.

- Fool around with an age-bag such Skrill if you wish to cash out profits effortlessly in the little to no costs, otherwise choose an electronic digital solution such as PayPal for individuals who favor unlimited distributions.

- When you are looking for becoming a business consumer, please visit the area branch venue otherwise complete this type.

- Buy a replacement card, declaration a missing out on otherwise taken credit or put subscribed users to their charge card.

- Focusing on how Dollars App protects pending deposits is very important to ensure to perform and you can track your inbound financing accurately.

5 Great Star real money | Electronic handbag accessibility

Transferring money otherwise cashing a accustomed encompass a call to your lender, and this can be each other cumbersome and you can inconvenient. However, cellular take a look at put features removed those individuals frustrations, and make of numerous banking deals as easy as bringing a photograph, any moment out of day. Pick from business examining, team playing cards, supplier features or visit our very own team financing center.

How does a mobile deposit con performs?

If you use this service membership to transmit whatever isn’t a product, or if perhaps for any reason we are not in a position to acknowledge as the an item, we could possibly deny they as opposed to past notice to you. You commit to build those places through other avenues that individuals give, for example during the a monetary heart, Atm, otherwise from the send, in the event the readily available. Your next agree to fool around with such almost every other avenues if the Solution isn’t offered.

After with this particular commission just after, might quickly obtain the hang of creating places in this means. B9 is deserving of it does not have any legal or 5 Great Star real money contractual claim up against you considering failing to repay a B9 Improve. B9 cannot render an associate which have subsequent enhances when you are people level of the previous B9 Advance remains delinquent beneath the B9 Advance℠ solution. Cashback amounts could possibly get go from day to day and therefore are topic for the B9 Cashback Program Legislation.

These types of Prices and you can Terminology & Standards can vary of those people relevant on the condition away from home and does not apply at the fresh accounts you discover on the web. After you unlock your new membership on the web, Rates and you may Terms & Criteria was determined by your state from household. It could be better to favor an account with a high interest rate or dollars-straight back advantages, depending on the purpose of the brand new account as well as your financial patterns.

A bank checking account is one of drinking water form of DDA, as you can be withdraw funds from they any moment. Offers membership, currency field membership and today account will get lay monthly exchange limitations otherwise require you to provide improve notice before accessing your money. A great “flexible order out of detachment,” otherwise Today, account is a checking account one to pays attention to the money transferred. The lending company can also be wanted no less than one week’ authored observe in order to withdraw finance, even though that is rare.

Utilize this post to find out ideas on how to deposit a check from the cell phone, and you won’t have to go the financial institution again. He’s an enthusiastic specialist and devotes their time for you level that which you payments. Since the recommendations is actually genuine, private efficiency and you will enjoy may vary. Particular people might have received compensation and other different incentives to own creating their recommendations. The people’ feedback are beneficial in order to all of us, and we try and supply the greatest solution to all or any the customers.

Legally, financial institutions have to build at least the original $225 out of an individual view deposit readily available for play with by next business day 1 . Remember that certain monitors may take more hours, particularly if it is a global transfer while the the individuals usually takes lengthened to ensure. Banking institutions are required to report bucks on the put accounts comparable to or in excess of $ten,one hundred thousand in this 15 times of getting they. The fresh Internal revenue service needs financial institutions to do so to quit unlawful interest, including money laundering, and to curtail money from supporting things like terrorism and you may medicine trafficking. In my opinion financial institutions will eventually ease off to their mobile deposit limitations but considering previous proof of how much time banking institutions to implement changes, it is likely getting a bit before that takes place. I guess I’ll wade spend my some time energy and you will drive on the bank rather so i is also spend the new tellers’ date.

You could put monitors via the Ally mobile application, and you may money arrive seemingly quickly. For those who’lso are choosing the better mobile asking casinos, where you could gamble properly from the cellular phone by just having fun with your mobile number and obtaining finance in just a spigot, read on! Cellular take a look at deposit is a straightforward and you may safe solution to deposit your bank account into the bank account without the need to make the trip to help you an actual venue.